Audio Timeline:

(0:35) - Business of Athletes

5 NBA players have invested in Fandex, a stock exchange allowing fans to buy and sell virtual shares of their favorite teams and players.

Mario Götze has invested in comstruct, a construction tech company.

Mike Trout’s golf course, Trout National, is scheduled to open in 2025. The course is being designed by Tiger Woods’ company TGR Design.

Derek Carr and Alex Smith are joining the recovery footwear brand OOFOS as ambassadors and investors.

Steph Curry is close to inking a lifetime deal with Under Armour ($1B+) that also includes an increase in equity.

(4:35) - NIL/College Sports

The Patriot League has said that if student-athletes become employees, it will most likely end all their sports programs.

Mattress Mack signed the entire Florida Atlantic men’s basketball team to NIL deals before the Final Four weekend (~$5,000 per player).

(06:50) - Sports Business

A $100M fund focused on women’s sports, The Monarch Collective, has been launched by Jasmine Robinson and Kara Nortman.

The first professional table tennis league in the United States has been announced to launch in 2024, Major League Table Tennis (MLTT).

DINK, the first-ever pickleball recovery drink has launched.

Trading card scanner Ludex has raised an $8M seed round that included investments from Brian Urlacher and Cassius Marsh.

Interesting Stat

Playing high-level sports has its benefits post-playing days as well…

Short Passage of The Week

The 5 core pillars of health:

Sleep

Nutrients

Movement

Light

Social Connection / Relationships

“Sleep, nutrients, exercise, light, relationships—those really establish the foundation of what I consider to be all of the elements that create our ability to move as seamlessly as possible between the states that we happen to be in and the states we desire to be in.”

Source: Dr. Andrew Huberman

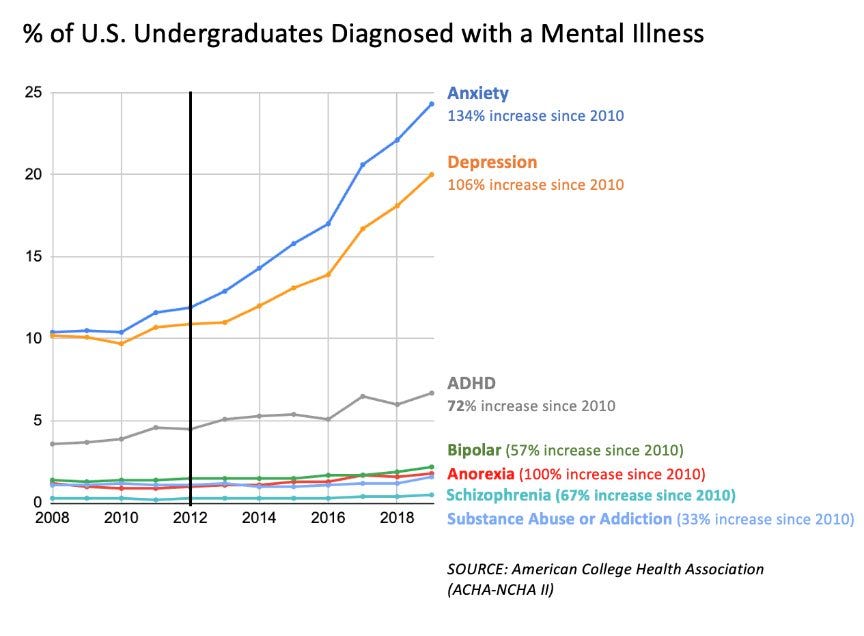

Interesting Stat #2

We have a problem sweeping through our youngest generations right now.

There are several contributing factors to this including social media, C19, an increase in medications, etc…

Sports are a great platform to address many of these things.

It’s great to see athletes and many new startups attempt to ease some of the problems.

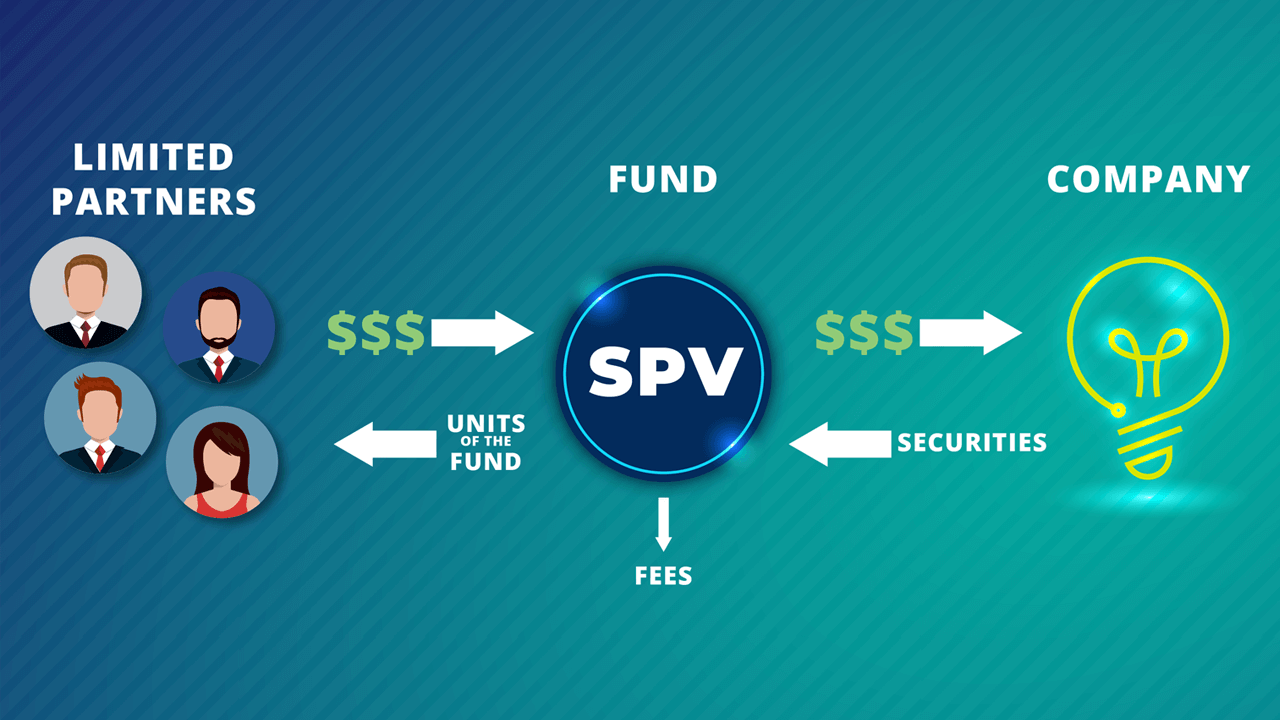

Business Jargon

What is a Special Purpose Vehicle (SPV)?

In venture, SPVs are used to pool money from a group of investors to make a single investment in a startup.

The main difference between an SPV and a venture fund is that an SPV makes a single investment into just one company — whereas a fund makes several investments into multiple companies.

Why investors use SPVs:

Access — Because SPVs allow individuals to pool capital, LPs can invest as low as $1k. Direct investments often have higher minimums.

Options — LPs select funds based on the GP and their investment thesis—but they don’t have a say in the specific investments the GP makes. With an SPV, everyone knows what the investment is, meaning no LP has to be part of an investment they’re not interested in.

Transparency — when investing in an SPV, investors don't have to participate in investments that they are not interested in

Quote

“When you arise in the morning, think of what a precious privilege it is to be alive — to breath, to think, to enjoy, to love ” - Marcus Aurelius “Meditations”

Thanks for tuning in today!

Peace,

-AP

Weekly Roundup: Business of Athletes, Sports, & NIL (March 27-April 2)