Audio Timeline:

0:00 - Feel good stories

Amazing story from the Ironman World Championships, Cooper Kupp giving back in a major way, and Patriots owner Robert Kraft donating millions.

2:25 - Business of Athletes

World Champion Fantasy, an online fantasy esports platform, announced JuJu Smith-Schuster is now an equity owner in the company.

UBS announced the second season of "Front Office", a reality TV show that follows superstar athletes-turned-investors.

TBE Enterprises announced on Tuesday that it's creating a $1 million winner-take-all 7 vs. 7 competition soccer event in 2023. Chris Paul is an investor.

Tom Brady and Kim Clijsters will be buying an MLP Pickleball team.

Patrick Willis, a former NFL great, announced the launch of Universe 52, a members-only NFT community where fans can interact with him and unlock access to exclusive perks.

Former Super Bowl champion Ryan Nece announced that Next Play Capital raised $200 million for its third fund.

8:10 - Name, Image, and Likeness

It pays to be the son of a famous athlete (two legacy names sign massive NIL deals)

Syracuse’s Jim Boeheim has some strong words about NIL.

12:05 - Future of Sports

NFT-based athlete investment platform FANtium announced a pre-seed round of $2 million. Fans can invest in an athlete's seasonal earnings, as well as in the career earnings of up-and-coming younger prospects.

The BIG EAST Conference will release NFT tickets to attendees covering its 2022 Basketball Media Day. Fans attending MLB postseason games can receive commemorative NFT tickets that update 24 hours before the event.

Puttshack, co-founded by the creators of Topgolf, just received $150 million in growth capital funding led by BlackRock. In 2023, they expect to expand to Dallas, Denver, Houston, Nashville, Philadelphia, Pittsburgh, and Scottsdale.

The MLB became the first major sports league in the US to enter an official contract with a CBD company.

Interesting Stat

This is wild…

Injuries across Europe's five major leagues rose by 20% last season and cost clubs $527 million, the first time this figure has eclipsed the half-a-billion mark. 🤯

*Injury cost is calculated by multiplying the daily cost of a player by the number of days they were unavailable.

Players under the age of 21 were especially affected, with their number of injuries rising tenfold in the last four years.

Yet, the increase in injury concerns isn't specific to soccer...

The NFLPA claims artificial turf leads to a 28% higher rate of non-contact injuries as compared to when playing on natural grass.

Short Passage of The Week:

Ask questions that are so big that only your life can answer them.

One of the biggest lessons in life is being able to distinguish between the stories other people have created about you and the truth you come to know about yourself...

You begin to reject the scripts that other people wrote for you when you recognize that those words and actions do not align with your vision for your life.

― Dr. Thema Bryant, Homecoming

Recommended Media

If you haven’t watched the Redeem Team yet…tonight is the night.

Unbelievable documentary.

Tweet(s)

Kim Kardashian has created $1B companies.

Lebron James is creating a billion-dollar empire.

Mr. Beast got offered $1B for his YouTube channel (and turned it down).

Take a look at the power of athletes, entertainers, and creators. 👇

Business Jargon

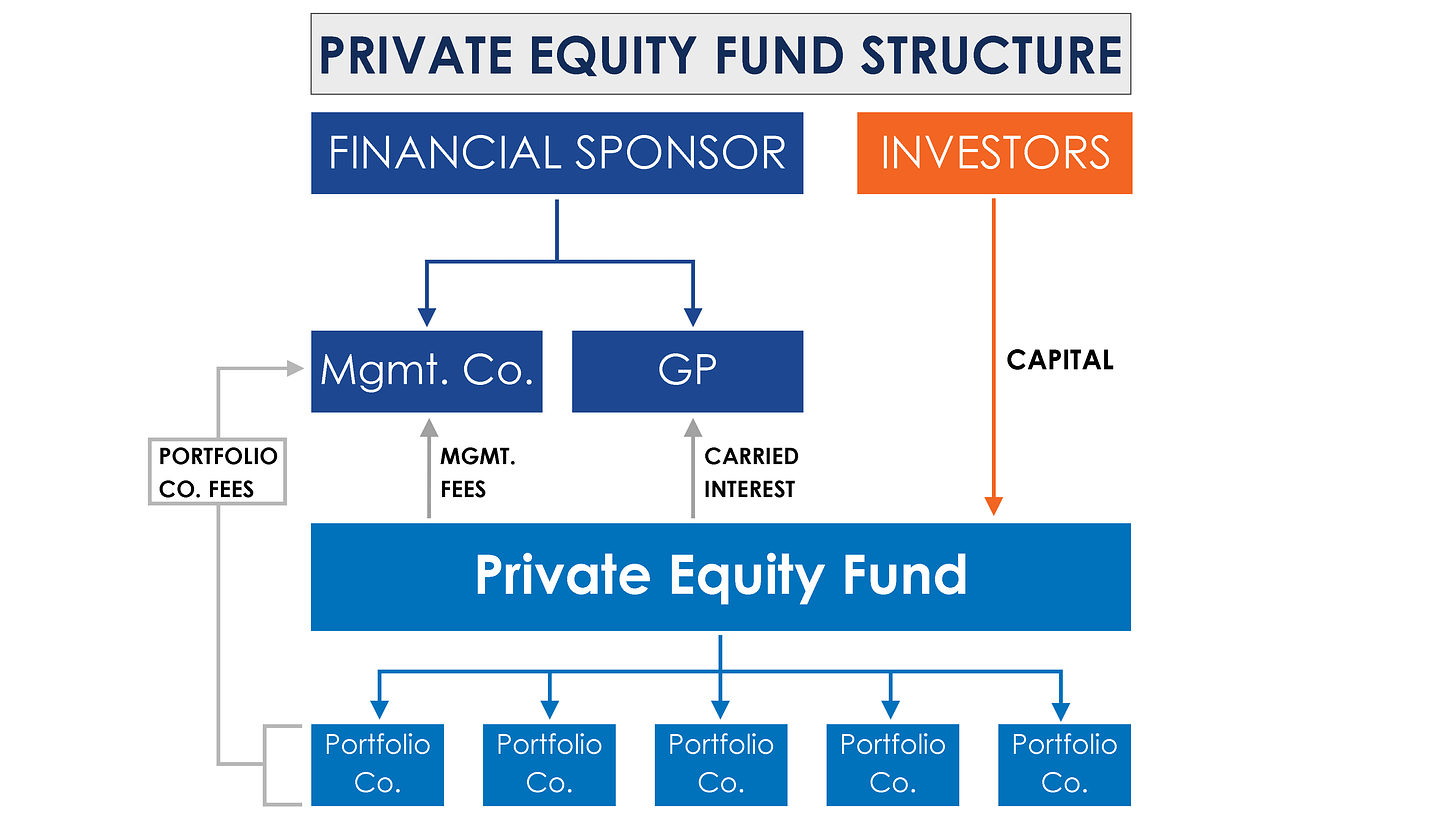

Private Equity (PE) has become popular in the investment world.

Here’s a simple breakdown of how it works:

OVERVIEW

Traditionally there have been two types of PE funds:

1. Buy-out funds: buy 51-100% of the business, often placing their own operators.

2. Growth Equity Funds: find large companies where they can inject capital to grow the business.

General Partners are usually the “founders” of the PE fund early on.

They raise money from institutional investors (can be a pension, a university endowment, or a family office).

They then use this money to make investments (either buy a company or invest in a company as mentioned above).

HOW PE FIRMS MAKE MONEY

There are two ways:

1. Management Fees

This is a fixed percentage of the total capital raised that they use to pay salaries and other operational fees (like lawyers and accountants). This is usually 2%.

So if you raise a $100M fund, you get $2M per year to split on salaries and operational expenses.

2. Carry Fees

This number is usually 20%.

What it means is after you return your investor’s money, you get 20% of every dollar after that.

So let’s say you have a $100M fund and you make $200M after exiting from the fund’s companies. You give $180M to your investors and you get $20M.

Quote

“Don’t judge each day by the harvest you reap but by the seeds that you plant” - Robert Louis Stevenson

Thanks for tuning in today!

Peace,

-AP

Extra Credit

You can connect with me on LinkedIn if you’re not already:

Weekly Roundup: Business of Athletes, Sports, & NIL (October 9-15)