A Shifting Market: The 12 Different Sports Investment Strategies

Insights for founder & operators on how they fit together, how to approach it, and where sports investing is headed next.

Profluence Sports Weekly Updates

📅 Upcoming Member Events

11/13 - Virtual Call for Southern California

11/14 - Family Office Insights with Ryan Petkoff

11/18 - NYC event w/ Citrin Cooperman

11/20 - Founder Workshop on staying compliant

12/9 - LA event at SoFi Stadium

Mid December: Pitch Competition w/ PEAK

🔗 Members can RSVP for events here

🎙 Podcast

Two profluence members building a cool company:

💬 New Members

Brady Walsh - PEAK

Dan Chelel - First Tee

Ray Rita - Fighter Foundry

Nakul Pednekar - Wicky.ai

Bryan - Blackbird e-Solutions

Rico Ripoly - The lemon house

Simon Pennock - Snap Sponsorship

Paul Rigault - DØDS® Diving League

🔗 Connect directly with new members here.

🗞️ Stay Ahead of The Curve

Don’t listen to us, listen to our members:

We’re continuing to improve, aiming to be the go-to place for the “builders shaping the future of the industry”.

Let’s Dive In👇

The Different Sports Investment Strategies

The question is no longer whether to invest in sports or not...

It’s about how you want to do it.

Here’s a breakdown of the 12 investment strategies currently taking place in sports (and how they fit together):

1. Institutional Plays

It’s the professionalization of sports ownership…but structured like private markets.

*some people refer to this as the financialization of sports

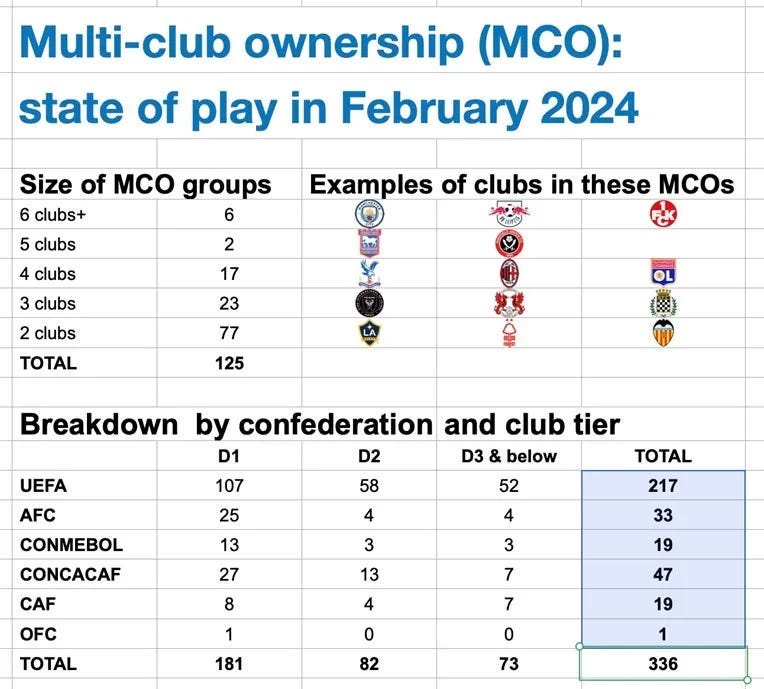

Multi-Club Ownership

Groups like City Football Group and Diamond Baseball Holdings are building global networks of teams where they share talent pipelines, sponsorships, and data infrastructure.

I often describe MCOs as “portfolio theory meets video game control.”

The reality is that some groups are doing it really well, and others are struggling.

We wrote more about Multi-Club Ownership here.

Private Equity Rollups

PE firms are consolidating fragmented verticals like agencies, youth facilities, and event operators into scalable national platforms.

Think Unrivaled or 3STEP, where they’re trying to combine operational leverage with recurring cash flow businesses.

We’ve touched on this heavily in our piece “The Youth Sports Industrial Complex.”

*a lot of new folks are trying to enter this space, but struggling to find anchor assets