Is Youth Sports in a Hype Cycle?

A report + market map on where billions in capital meet fragmentation, hype, and a few clear winners.

As a reminder for members…

You get FULL ACCESS to this report and all the future ones on the Profluence platform.

Not yet a member?

Hype Cycle of Youth Sports

Is it $35 billion, $50 billion, or even $75 billion now?

The youth sports economy is creating a lot of noise right now…

But is it just a hype cycle?

Some key things currently taking place:

Billions of dollars are pouring in, accelerating growth and consolidation across every level.

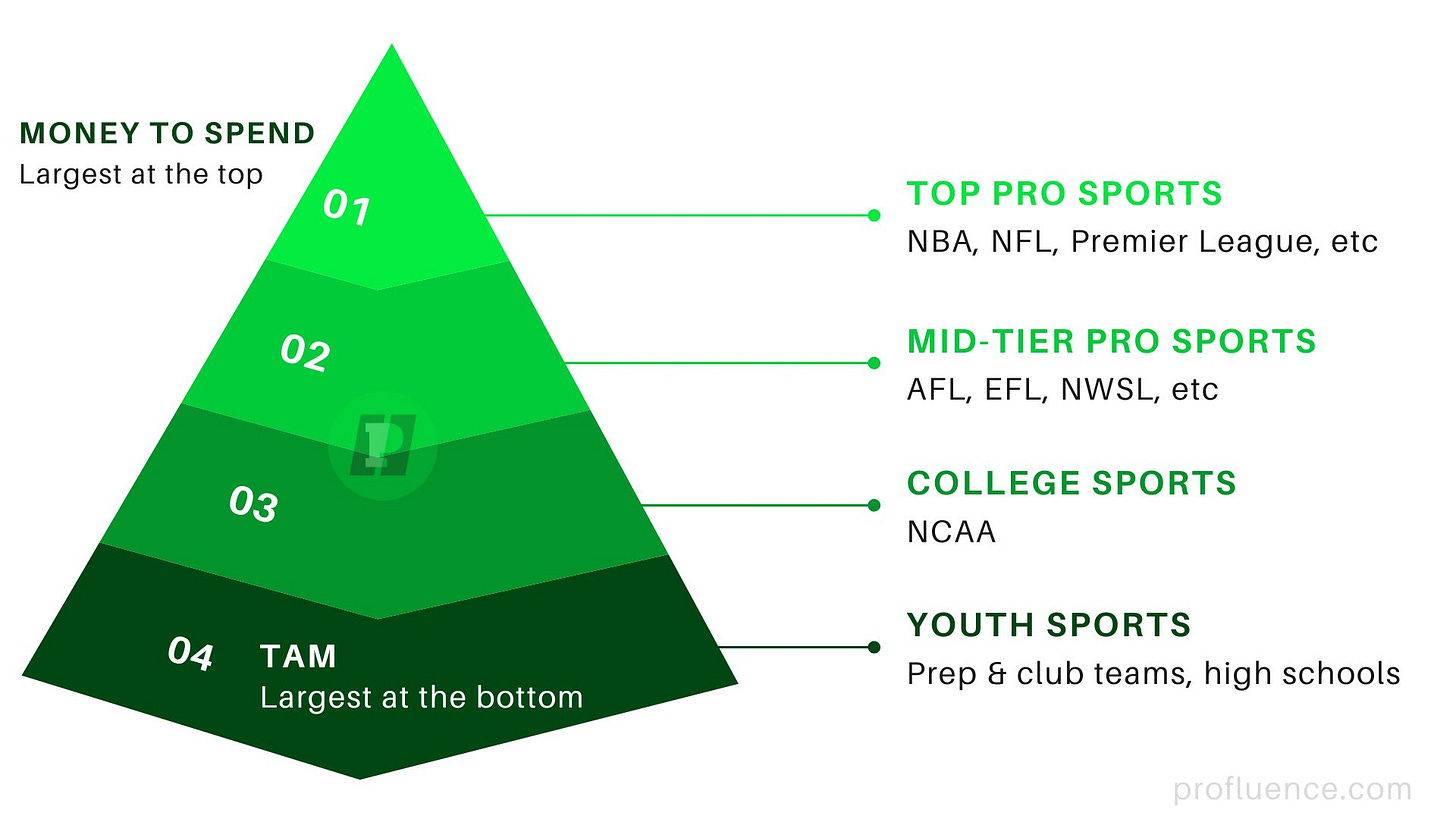

Two different markets are taking shape:

Programming – the on-field experiences (Unrivaled, Rocket Youth, RCX).

SportsTech – the software infrastructure (TeamSnap, GameChanger, EventConnect, Hudl).

Investors are chasing both, but the tech side is where scale and recurring revenue live (however, they are reliant on the programming/layer one solutions).

There is a lot of noise surrounding announced funds; however, the scarcity of assets presents a real challenge in actually deploying intelligent capital.

Let’s Dive In 👇

Valuations in Youth Sports Tech

To start…

Entrance into the space is a massive challenge due to fragmentation, seasonality, the local value proposition of community-based usage, and the split between B2B and consumer software.

But it does create a compelling opportunity:

The top-valued assets are based on core investment fundamentals (recurring revenue, strong margins, retention, growth, distribution), but a lot of noise & hype is starting to grow on the lower end of the market.

Few assets are truly well-positioned to win – scale and size matter here.

I created this chart to show you the different valuations of the current top youth sports tech solutions (from ~$100 million to $1.5 billion):