Women’s Sports Funds Report: (And Why It’s Just Starting)

A deep dive into the funds, investors, and strategies fueling the women’s sports boom.

In just the last two weeks:

another women’s sports investment fund just launched (there are now 15+)

investment bank Whitecap Sports created a dedicated women’s sports division

From media to ownership groups to innovation hubs, a growing number of investment funds and capital vehicles are betting big on women’s sports.

This isn’t a trend…

It’s a shift in capital allocation (and it’s accelerating).

We’ll break down all of the different women’s sports funds, but first…why now? 👇

Why Now For Women’s Sports Funds?

The investment thesis for women’s sports is becoming impossible to ignore.

It’s forward-looking capital seeing an asymmetric opportunity.

Let’s break down the major tailwinds:

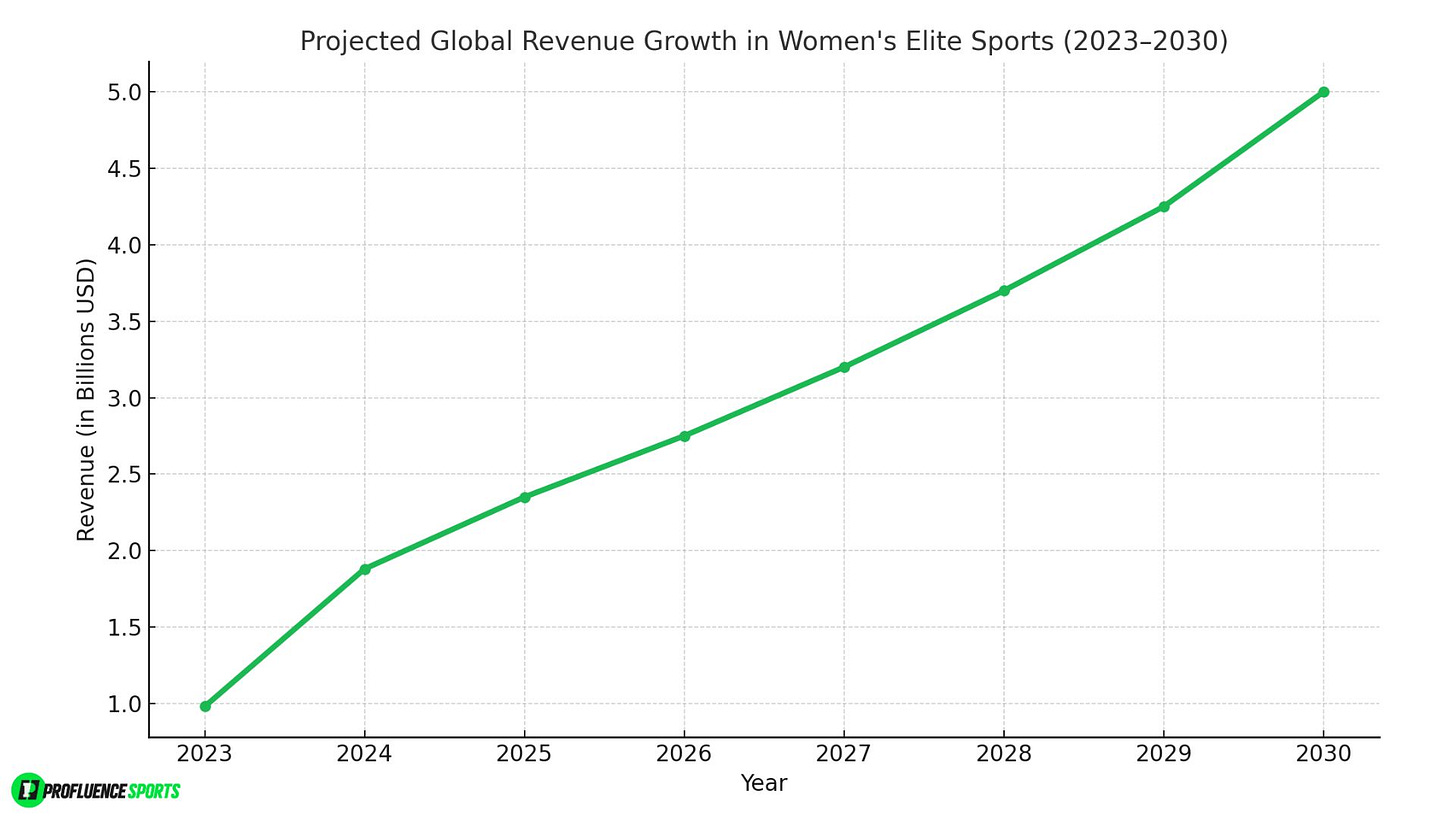

Rising Valuations Are Just the Beginning

Franchise valuations in women’s sports are growing faster than their male counterparts (off a much lower base).

The WNBA’s latest expansion team in the Bay Area sold for $50M (10x what prior teams went for just a few years ago).

NWSL franchise values have crossed the $100M mark, with Denver’s 2025 expansion reportedly setting a new record.

The PWHL was built in just 12 months, thanks to significant financial backing and national broadcasts in both the US and Canada.

What’s driving this?

Rising attendance, record-setting media viewership, and massive sponsor interest from brands eager to align with new fanbases.

Cultural Momentum is Fueling Demand

Women’s sports are no longer just about the game.

It’s about the story:

Athletes like Caitlin Clark and Angel Reese are becoming icons with real cultural gravity.

Platforms like JWS and The Gist are telling these stories directly to fans (via TikTok, YouTube, newsletters, and podcasts).

We’re seeing viral moments that transcend sport. For example, the WNBA Draft outdrew the MLB, NHL, and UFC that evening.

This momentum isn’t being manufactured.

It’s organic, grassroots, and is finally being captured by sports media sources.

A Historically Undercapitalized Market

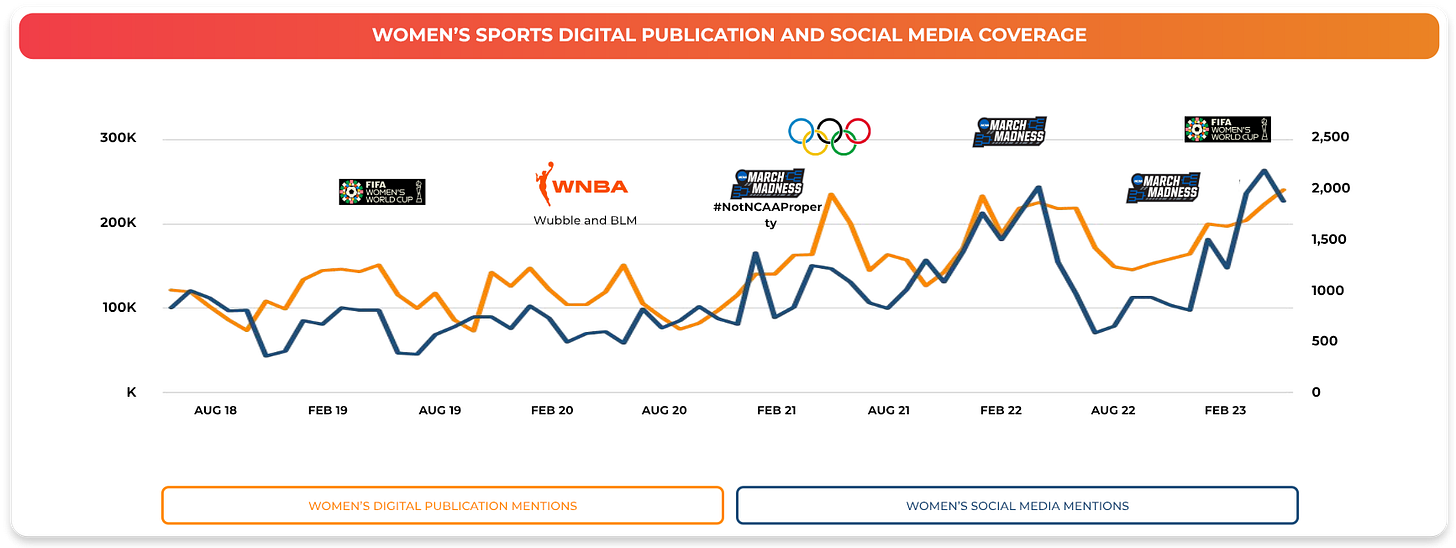

Despite being half the population, women’s sports have received less than 2% of all sports media coverage and sponsorship dollars over the past two decades.

Let that sink in…

We’re not talking about an overvalued space.

We’re talking about a massively undervalued one with all the fundamentals now pointing upward.

As women’s leagues gain distribution, better broadcast windows, and corporate support, the capital inflows are inevitable.

The International Opportunity is Exploding

It’s not just the United States, but international interest:

Women’s soccer is attracting crowds of 50,000+ fans at matches in England, Spain, and Mexico.

Volleyball is booming in Brazil, Japan, and now the U.S., with the introduction of 3+ leagues (including the recent MLV and PVP merger).

Combat sports like MMA and boxing are seeing surging female participation and headlining fights.

Media rights for women’s sports are being unbundled from men’s for the first time (and leagues are starting to control their own commercial destiny).

Brand sponsorships are growing faster than men’s thanks to the global fanbase expansion, especially Gen Z women.

Ownership is Changing Hands

Perhaps the most important shift?

Women aren’t just on the playing field…they’re in the boardroom, the cap table, and the front office.

Kara Nortman (Monarch Collective), Michele Kang (Cognosante), and Serena Williams (776 Capital) are showing a new model.

More female athletes are turning into investors, founders, and team owners (helping shape the future they once had no stake in).

This change in who owns, leads, and funds the future of sport will be the biggest multiplier effect of all.

The Women’s Sports Fund Landscape

Here’s a growing list (and market map) of funds putting serious money behind women’s sports:

*Many of these funds launched in just the past 12–24 months (and aren’t just writing small checks).