When Fund Math Meets Sports: Here’s What It Reveals

$100M vs $1B funds, exits, and adjacencies...what the numbers tell us about sports investing.

In today’s briefing, I want to break down venture/private equity fund math, what’s taking place in the macro ecosystem, and how this relates to sports.

This is one of the more critical pieces I’ll release this year.

Enjoy,

Andrew Petcash

Fund Math for Sports

In recent years, sports have turned into a game of math:

Basketball has evolved into an equation around expected value per shot.

Baseball became “Moneyball,” reducing players to on-base percentages and slugging ratios.

Cycling is coming down to a high power-to-weight ratio.

Even soccer now tracks expected goals.

Venture is the same way (at least for the broader ecosystem).

The VC industry is mature, with a wealth of data on fund performance; however, the sports investment industry has little data, as it is relatively new.

Let’s Dive In 👇

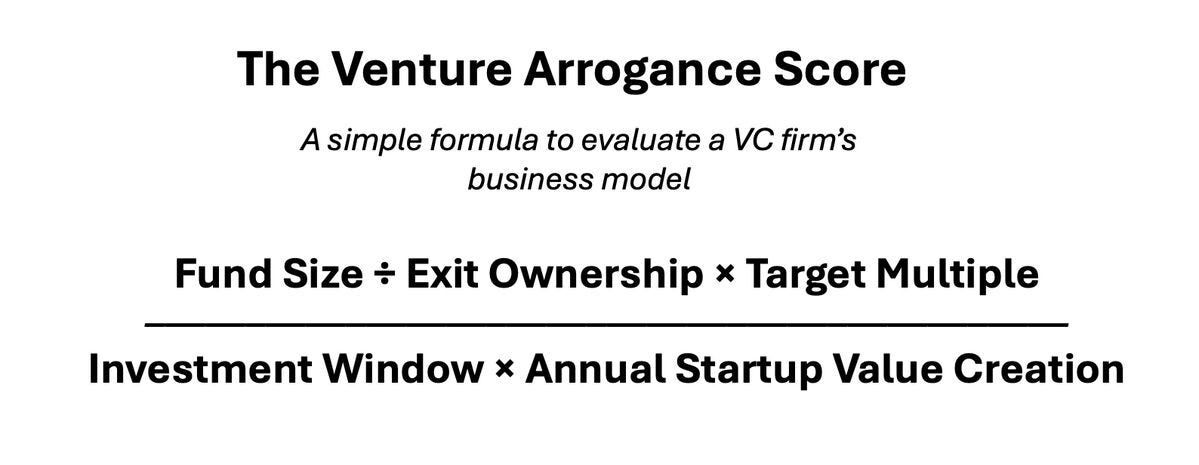

The Venture Arrogance Score

Venture capitalist Josh Kopelman recently shared what he calls the “Venture Arrogance Score,” a formula for evaluating VC firms.

The score answers the question: what percent of “total annual startup value creation” does a fund need to capture to generate its desired return?

This chart does a nice job showcasing it:

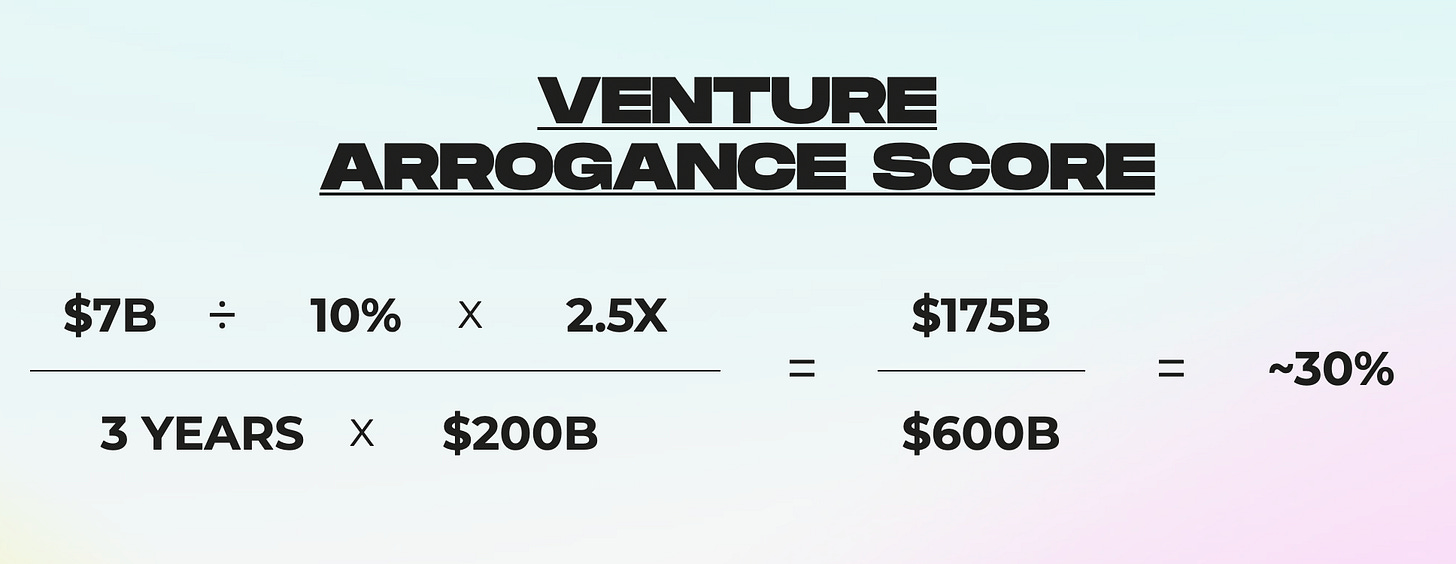

Assumptions for this sample fund:

$7 billion fund with a 3-year investment window

fund owns 10% of the companies at exit

aims for 2.5x returns (note that 2.5x is a pretty low multiple for venture; we’re in growth equity/private equity territory.)

The final variable is “Annual Startup Value Creation,” and PitchBook reports that about $2 trillion of total U.S. venture returns have occurred over the past decade, or approximately $200 billion per year.

The Venture Arrogance Score is telling us that the sample firm has to capture ~30% of all value created in the startup ecosystem. That’s…really hard.

The math for large VC funds is tough.

Sports Fund Example

Now let’s look at a $5 billion sports fund focused on minority stakes in teams, leagues, and later-stage companies (this is the size of the fund Apollo Global Management plans to launch).

*The Venture Arrogance Score was designed for traditional VCs, but with sports team and league PE groups being their own ecosystem, we can apply the same math.

Assumptions we’ll use:

3-year investment window

10% ownership at exit

3x return target (fund needs to turn $5B into $15B).

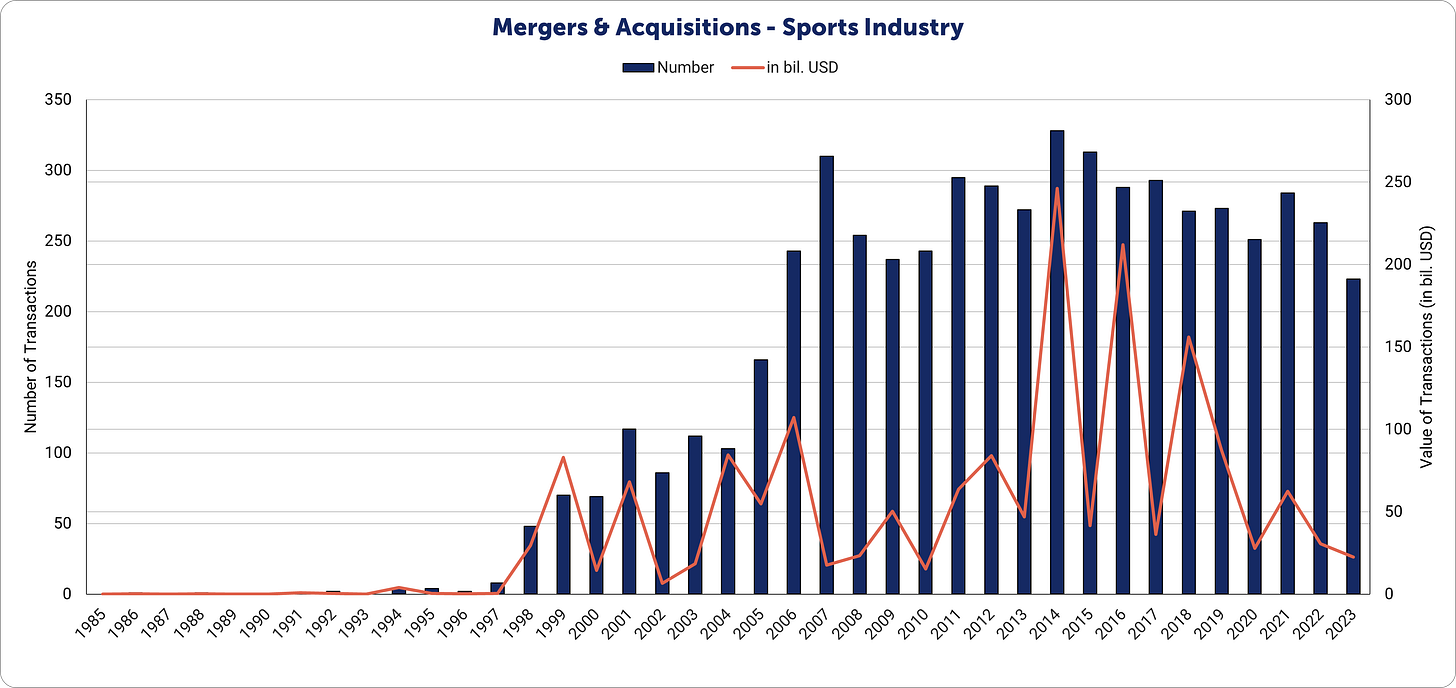

Using rough estimates, the sports industry has averaged ~$125 billion in transaction value per year (or about $375 billion over three years).

For the $5 billion fund to hit its target…