The Rise of Athlete Communities (+ Platforms)

Everyone wants the athlete which is why communities are being built around them (investing, charity, networking, etc).

Modern-day star athletes are armed with capital, clout, and expertise.

Which is why…

A bunch of early-stage companies & funds are now creating communities/platforms around athletes.

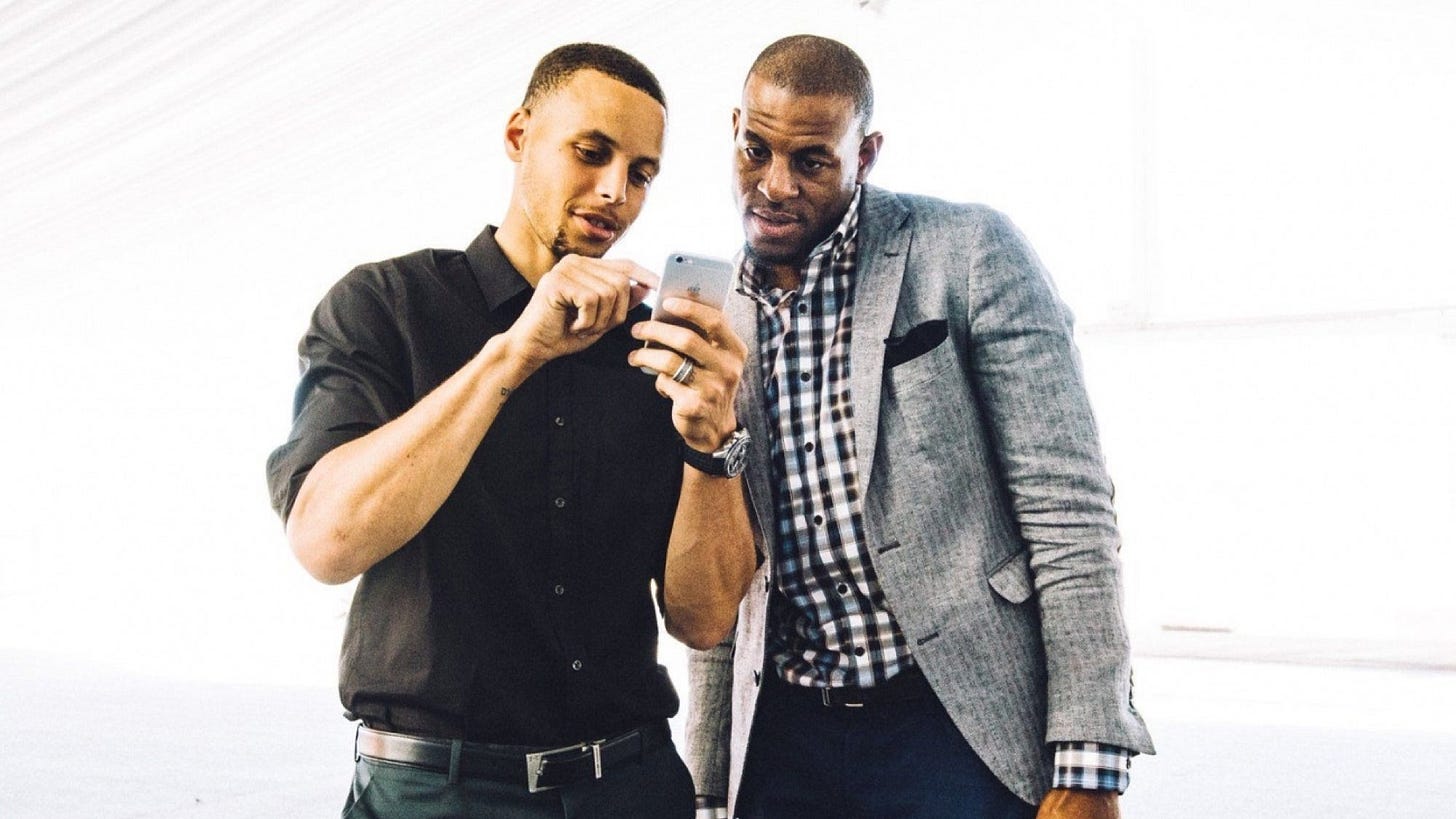

For example, Steph Curry acts more like a businessman than a rockstar.

invests in companies

runs his own entrepreneurial ventures

and gives back to the community

It’s now about cr…