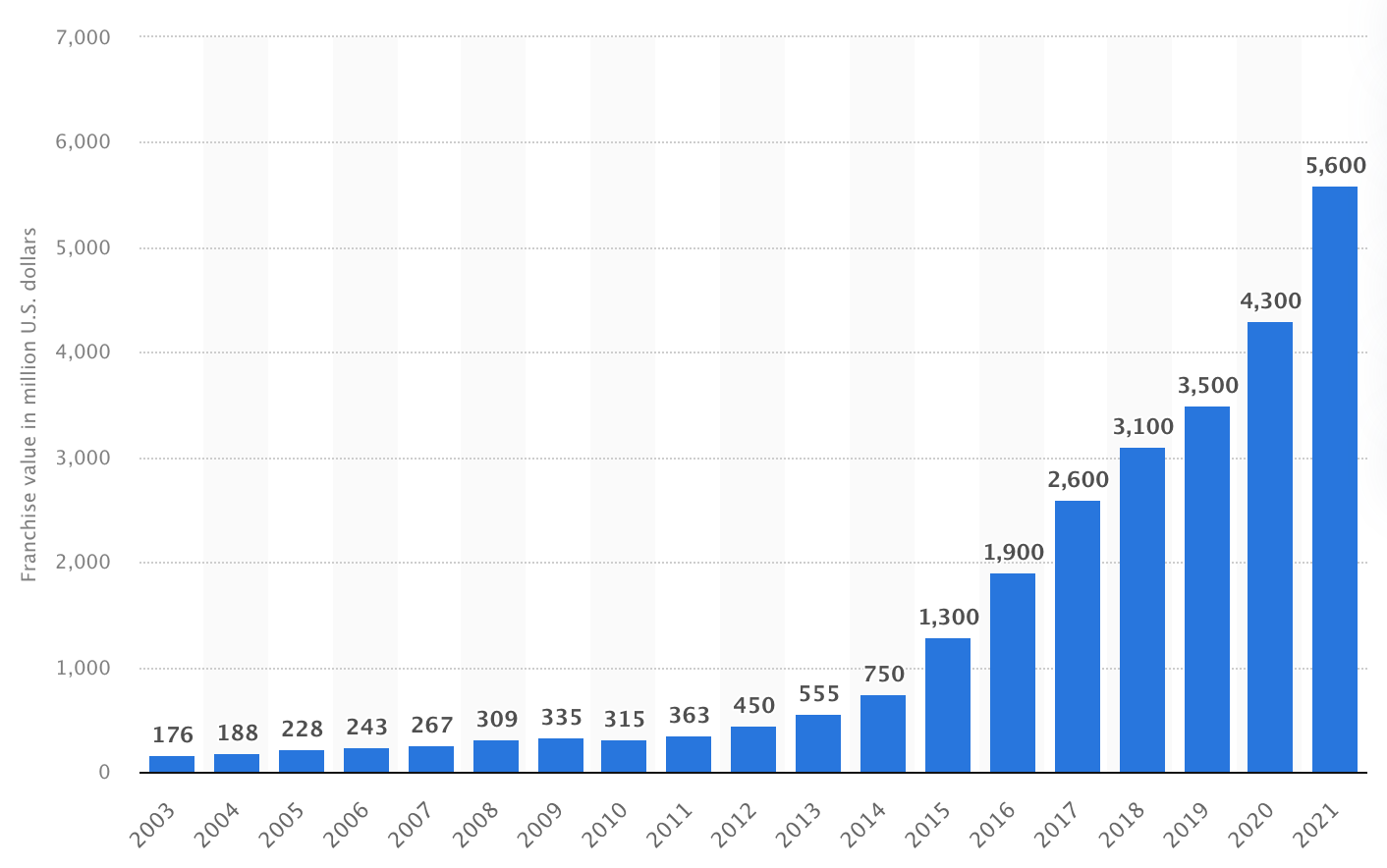

The $5.6B Business of the Golden State Warriors

Golden State Warriors or Silicon Valley Warriors?

Last night, the Golden State Warriors played in their 6th NBA finals in the last 8 years.

Since Steph Curry was drafted in 2009, the valuation of the Golden State Warriors has skyrocketed from $335M to over $5.6B — an increase of 1,572%.

Winning brings great things — including a lot of money and growth opportun…