Digital Sports Media Publishers In 2022 (The Complete Report)

The sports media publishing scene, future trends, main players, and who stands to benefit the most.

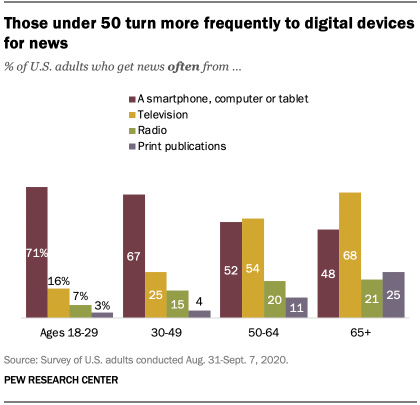

I just turned 24 years old and I think it’s fair to say that I’ve read a newspaper maybe 3 times in my entire life (and they all involved me reading about myself during my high school basketball days).

So where does the younger generation get their sports news?

Digitally.

For a large percentage, it’s on video platforms such as Tik Tok, Instagram, YouTube…