M&A Mania: The Financialization of Sports Is Set to Ramp Up

With billions circling sports, mergers & acquisitions are set to ramp. We break it all down here.

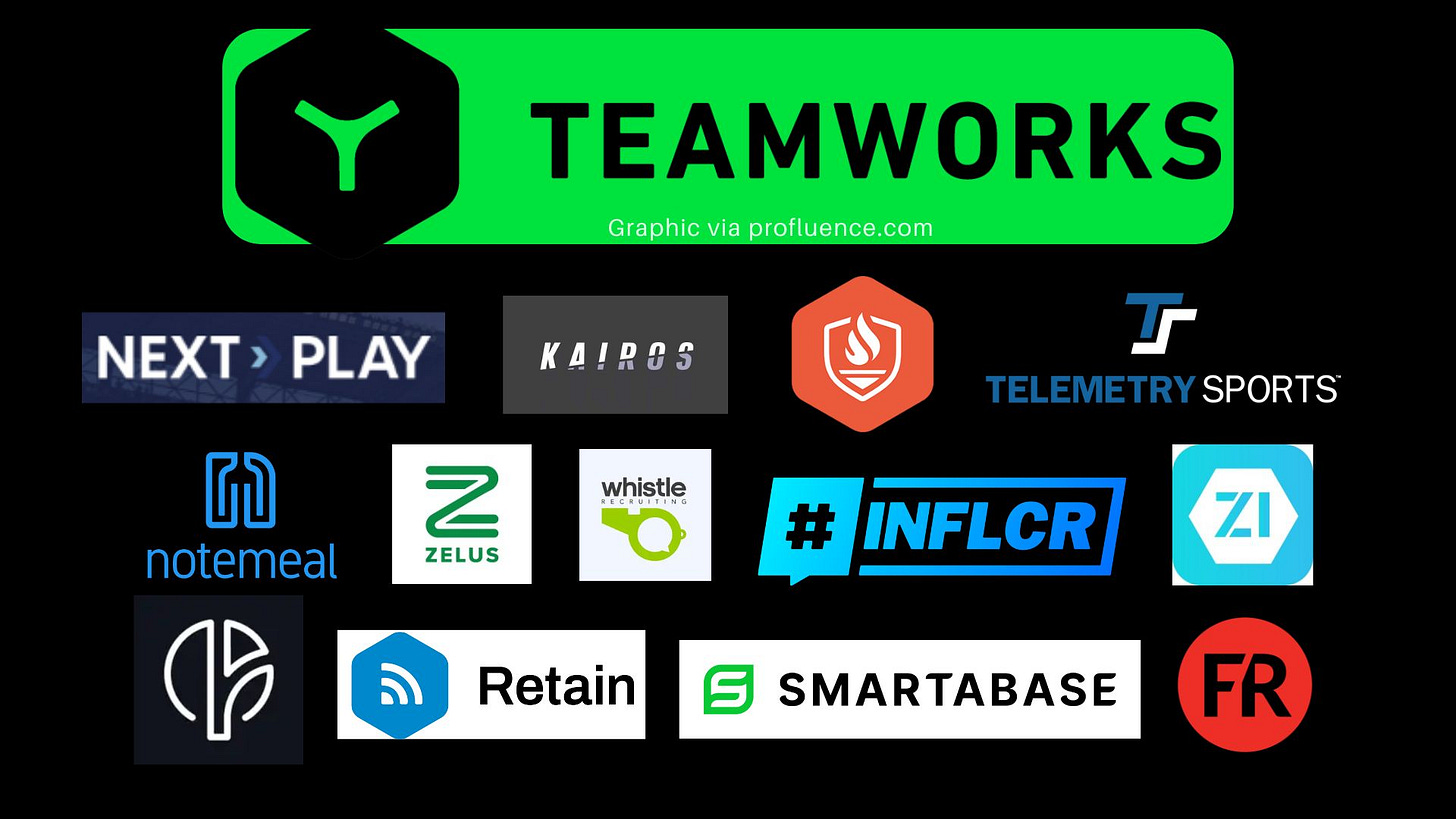

Sports operating system Teamworks just raised $235m…

They’ve already acquired dozens of companies (and this will only accelerate further).

Today, I take a look at M&A across sports and where it’s likely going.

This is important info for anyone building in the space, as this is exit liquidity.

Let’s Dive In 👇

*Quick Refresher:

M&A stands for Mergers and Acquisitions. It refers to the consolidation of companies or their assets through various transactions, such as mergers, acquisitions, and takeovers. Essentially, it's how companies grow by combining with or buying out other companies.

Teamworks Raise

First things first…

It’s AWESOME to have another $1B+ valued company in sports.

Following the Series F funding, here’s where Teamworks is going next…

Lots of acquisitions, I would suppose.

Enhance AI capabilities, grow data science team, & upgrade platform features.

The end goal for Teamworks?

To be the operating system powering all sports teams.

Some other things to note:

Dragoneer led the last round, so this is an internal way to mark up your book as well.

Traditional Silicon Valley investment firms are starting to show more interest in the sports industry.

This deal interests me deeply on something else…

Bigger groups entering sports with large minimum check sizes.

Sports Investment Getting Top Heavy

We’ve now entered a super interesting time in the sports world.

There is a lot of capital ready to be deployed across sports at the $30 million-$200 million check size range…but only so many opportunities.

What I’m watching is how this impacts M&A.

For founders, I believe there is an incredible opportunity to build niche solutions that can be acquired.

Especially with all the AI tools that can now streamline building.

I ALWAYS encourage founders to shoot BIG…but there will likely be a lot of acquisitions in the $3 million-$20 million range.

Why?

To reach the ideal check sizes, many of these investors will have a hard time finding one-off deals like Teamworks, so they will have to roll multiple things up.

I foresee them finding a base asset they take a position in, and then acquiring smaller solutions around it.

Acquirers To Watch

I based this on those with a history of acquisition and/or flush with cash.