Why Emerging Sports Leagues Stand a Chance

an inside look at challenger leagues and what the future holds for them...

Have you ever randomly turned on the TV and found the most bizarre sports playing?

Cornhole, pickleball, or slamball.

Interestingly…

This is just the start of emerging leagues.

Let’s Dive In 👇

Emerging Sports Leagues

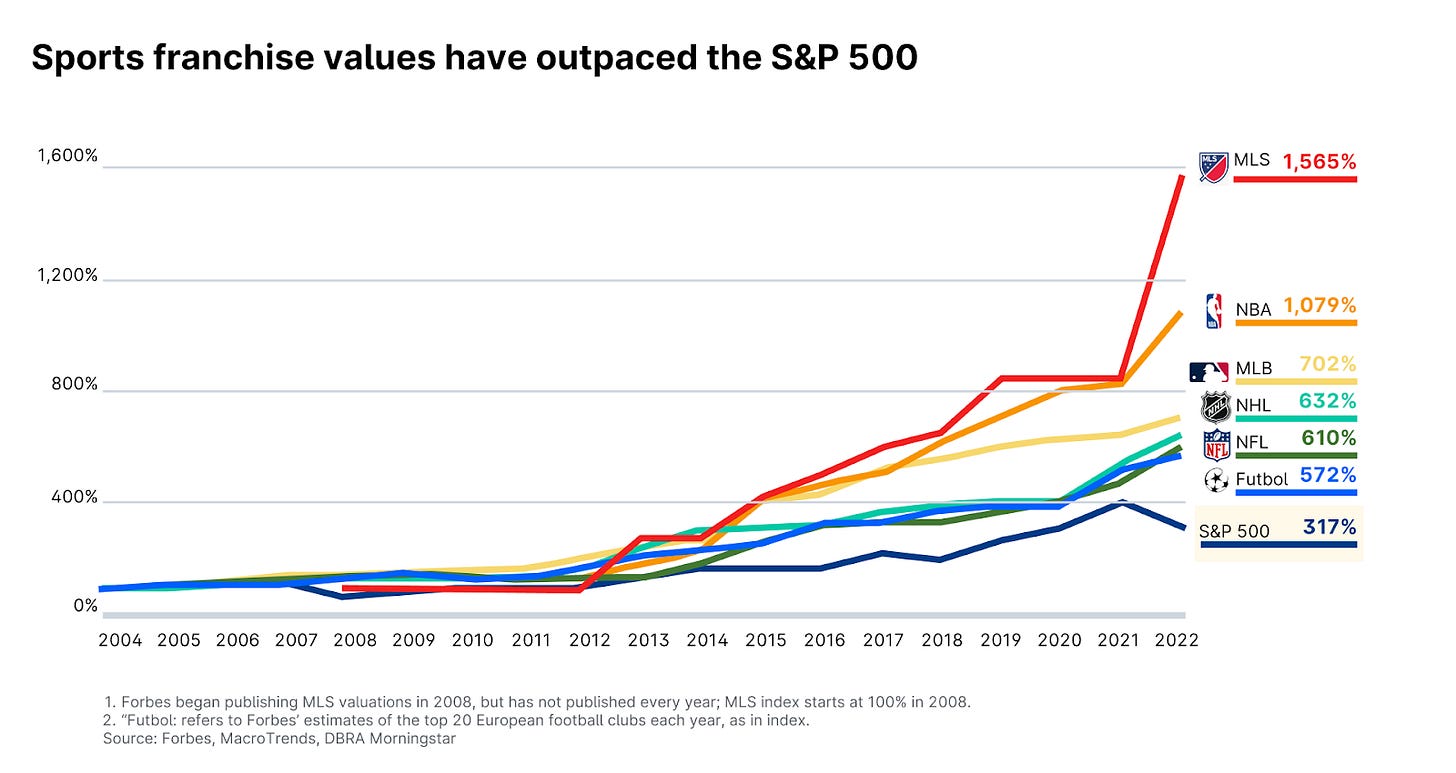

~$30 billion of investment capital has flowed towards sports leagues, teams, and media assets since 2020.

Take a look at some of them:

WNBA: Va…