2025 Halftime Report: The State of Sports Business

6 months through 2025...let's take a look at the major trends and what else to watch through the EoY.

My main takeaway so far this year…

Sports will be one of the best industries to build in over the next decade.

Why?

Because tech is no longer the moat…distribution, brand, and live interaction are.

And sports offers that at scale:

Media - one of the last places for live eyeballs

IP - brand and distribution will be greater than tech

Entertainment - authentic interactions mixed with sports

Participation - from youth to college to pro to adult rec, tech can’t replace activity

Let’s Go Deeper on H1 2025 👇

H1 2025 in Sports Business

The first half of the year was loaded with movement!

Here's what stood out the most:

More Large Funds Targeting Minority Stakes

Mark Cuban unveiled a $750 million sports fund.

Dave Checketts, former MSG Sports CEO, announced a $1.2 billion fund.

TPG (a $250B+ private equity giant) launched a $1.6 billion dedicated sports investment vehicle alongside Rory McIlroy.

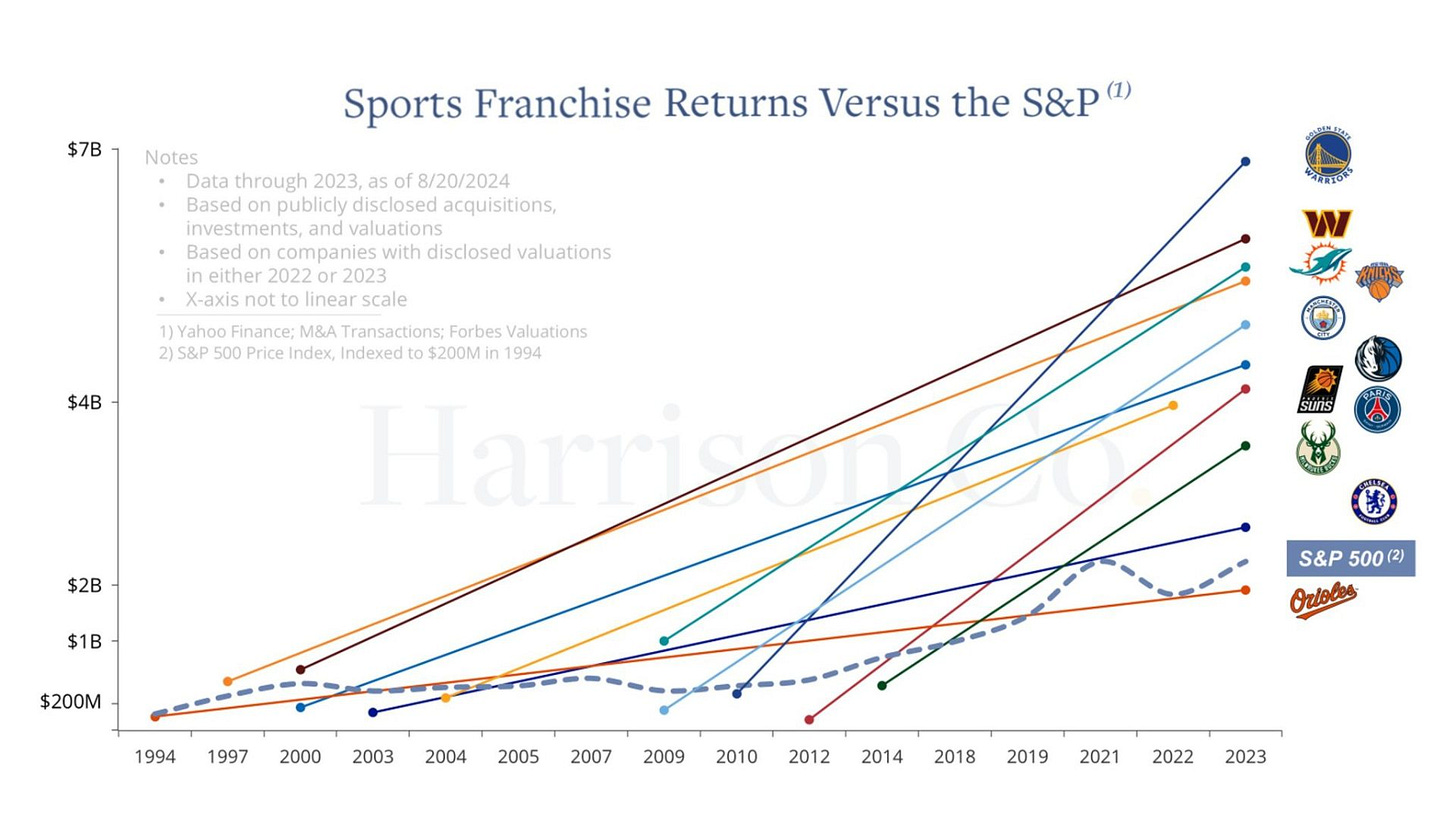

They want to capture a small sliver of this…

I expect to see more announcements in this area over 2025, but we’ve likely reached the peak, as the scarcity of teams caps how many funds can operate here.

The Gap Largens in Early-Stage

I’ll keep iterating this until I’m blue in the face…

There are numerous groups deploying capital into sports now, but very few do so at the early stages (which can mean either directly or indirectly through funds).

This will create problems over time, as there are fewer capital onramps into sports.

So, why is this happening?

Three key challenges at the early stages of sports:

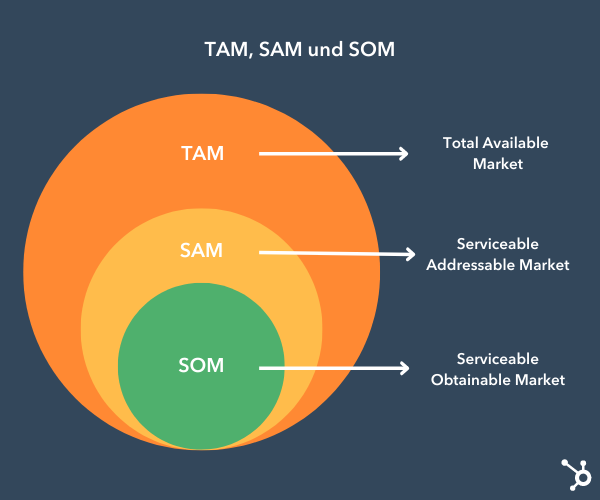

Fragmentation

Funds playing the AUM game

Uncertainty around market sizes

Due to the reasons above - I expect the early stages to remain turbulent for founders through the end of the year.

We’re trying to narrow the gap with the Profluence platform, as there are other ways to build a company successfully beyond just raising capital.

College Sports is Unraveling (Quietly)

The House v. NCAA settlement is reshaping college sports economics: ~$2.8B in damages and revenue sharing for athletes ahead.

What’s the implication?

Schools are becoming semi-pro teams - with new budget structures, revenue models, and labor dynamics on the horizon.

Elevate Sports Ventures, a management consulting firm specializing in teams and leagues, has reportedly raised a $500 million fund to invest in the collegiate space, with the capital support of Velocity Capital Management.

The thing is…

Most college programs aren’t profitable, so expect funds in the space to be in the business of lending (not writing equity checks).

Miniaturized Sports Increasing

Unique versions of sports continue to pop up.

Think 3x3 basketball, simulator golf, condensed racquet sports, etc.

Five reasons why:

lower barriers to entry

internet is fragmenting

new monetization avenues

changing consumer behavior

shifting league capital-raising models

I don’t see these concepts slowing down anytime soon.

M&A Remains Strong

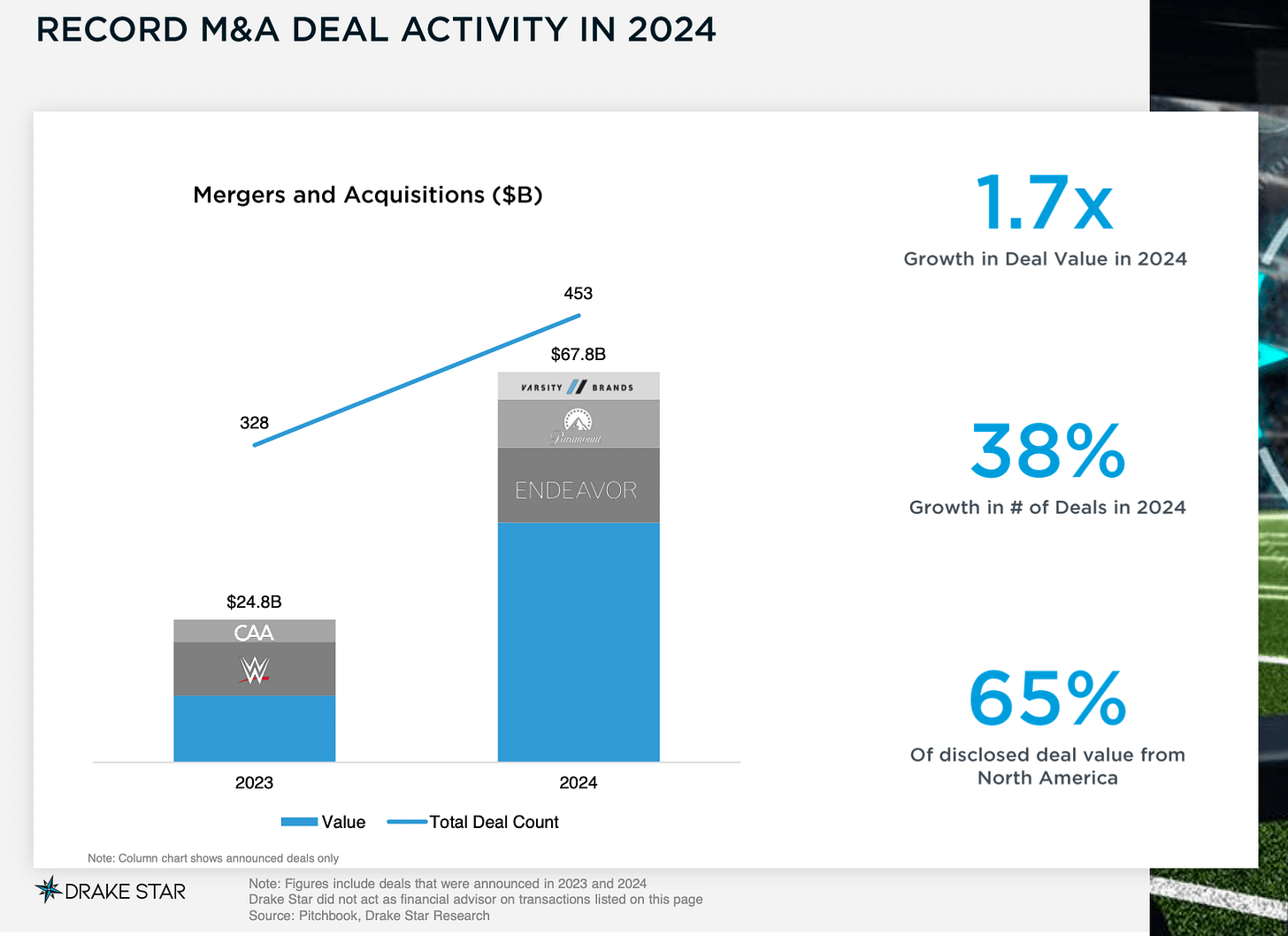

2024 was by far the strongest year in history for sports M&A.

Teamworks recently raised $235m in a Series F round. I expect them to make multiple acquisitions in the months to come.

2025 is off to a strong start in M&A - we will break this down further at the end of the year.

Several large funds are also entering the space, creating a need for those at earlier stages to consolidate entities to make these investments more attractive:

Norwest Venture Partners (backers of Uber, Calm, & Opendoor) is interested in doing more deals within sports.

General Atlantic ($100B AUM) expressed interest in doing more sports investments.

RedBird Capital raised $4.7B in fresh capital and partnered with Weatherford Capital to take on college sports.

Interest in the growth stages of sports is at an all-time high.

Big Leagues Acting More Like Investors

MLB is showing this heavily so far this year…

minority investment in Jomboy Media

minority investment in Athletes Unlimited (softball)

It makes sense for leagues to invest capital in initiatives that they help drive forward…

This is why the NFL expanded its strategic partnership through the 2030 Super Bowl with Genius Sports (they are also the largest shareholder).

Recently Added Resources in Profluence

2,500+ Angel Investors List

300+ VCs That Accept Cold Pitches

The Ultimate Startup Data Room Template

144 Family Offices That Cut Pre-Seed Checks

Cap Table Mastery: How to Manage Startup Equity

How VCs Value Startups: The VC Method + Excel Template

The Startup Founder’s Guide to Financial Modeling (7 templates included)

What I’m Watching in H2 2025

It’s super important for anyone building in sports to keep an eye on these developments: