2023: Another Big Year in Sports Tech

Breaking down the most important takeaways from 2023 across the sports industry.

Time flies.

The first full year for Profluence is now in the books.

Sports tech had an eventful year.

And both, using a baseball analogy, are still in the early innings of growth.

Let’s Dive In 👇

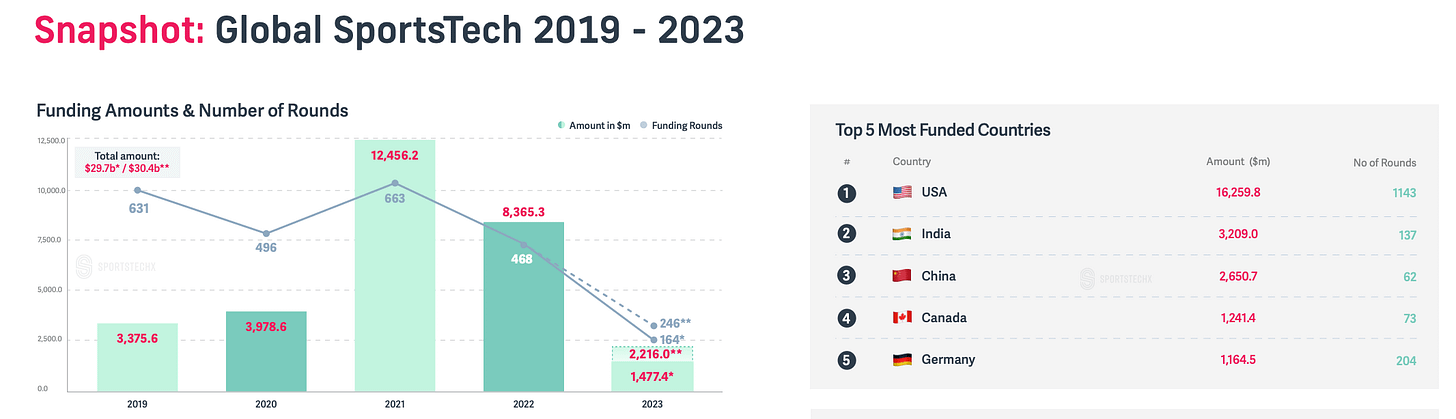

Fundraising

While the last month has exploded with deals (hopefully a sign of what’s to come in 2024), most of 2023 was pretty slow on the startup side.